| | Need advice or a free consultation. Contact Tom Ginn [email protected] We can get you on the right track and move to a place and mindset of prosperty thinking. |

|

0 Comments

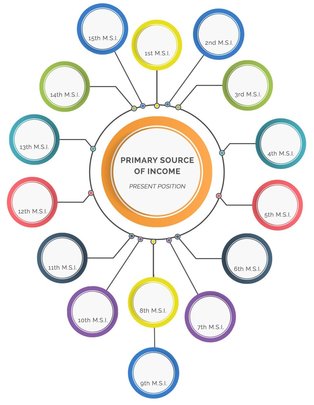

Multiple Sources of Income (MSI) is a technology that will permit you to multiply your present income by providing service beyond that which you are presently providing at your primary source of income. ADDITIONAL SERVICE – ADDITIONAL INCOME. Through MSI Technology you will earn many times what you are presently earning at your primary source of income. MSI is a concept that has been adopted by virtually all wealthy people. Multiple Sources of Income is exactly what it says it is: INCOME FROM MULTIPLE SOURCES MSI is not another JOB. MSI is not a better JOB. MSI is not even a JOB. MSIs are a way of adding a new dimension of excitement and fun to your everyday life, while you are becoming very wealthy. An MSI is an idea with which you are in harmony. An MSI is an idea that enables you to provide service to humanity in a lawful manner for which you will be fairly compensated. The compensation you receive from each MSI could be minimal or it could be millions of dollars per year. An MSI should not interfere with, nor cause you to jeopardize your position at your primary source of income. It’s been explained that an MSI (Multiple Source of Income) is not another job. In fact, it’s not even a job. It should be viewed as a source of income that is passive. Many people confuse creating an additional source of income for themselves as getting a part time job. Though that is one way of creating an additional source of income for yourself, it’s not one we recommend. Why? Because, you’re trading your time for money and eventually, you’ll run out of time. Begin developing MSIs. Set an immediate goal to have 15. Fill in the spaces provided and make this your Wheel of Fortune Another important point to consider when you create MSIs is: you want to focus on creating “passive” sources of income as often as possible. By passive we mean that it shouldn’t take a lot of your time or energy … it’s just something that’s there, where you receive money on a regular basis because you contributed in some way or another. Granted, there may be an initial output of time and energy to get it started and it may or may not be extensive, depending on the MSI. But, after that start up phase, it’s considered mailbox money or earning money while you sleep. HerYou can get really creative with MSIs. If you’re an independent contractor – let’s say you’re a graphic artist … you could create a piece of artwork (maybe a book cover) and instead of charging your regular fee up front for the design, opt to take a percentage of the total sales and offer to design it for no upfront fees. You’ll more than recoup your investment of time … and it will be money that keeps coming to you as long as the person keeps selling their book. Begin developing MSIs. Set an immediate goal to have 15. Fill in the spaces provided and make this your Wheel of Fortune tYOU DECIDE ON THE NUMBER OF MSIs YOU WILL HAVE If a person advances confidently in the direction of their dream and endeavors to live the life they have imagined, they will meet with success unexpected in common hours. – Thoreau HOW RICHES COME TO YOU Never look at the visible supply; always look at the limitless riches in the formless substance and know that they are coming to you as fast as you can receive and use them. Nobody, by cornering the visible supply, can prevent you from getting what is yours. – Wallace D. Wattles  We all have experienced the “drip-drip-drip” of a leaky faucet. It’s not only annoying, but if left unattended, it could add up to thousands of gallons of wasted water and a very large water bill. Individually each water droplet that is wasted is a fraction of a penny, but over time the pennies will add up to dollars. Many of our everyday purchases are also causing a drip on our finances. Some of it is due to poor money management and others are due to our lack of attention to detail. At times it can be difficult to detect financial leaks, but with some proper tools, you will be equipped to fix the financial “drip-drip-drip”. The average smart phone owner uses 256 MB of data each month but pays for 10 GB. With a simple review of your usage, you could significantly save on your plan every month. Check your auto insurance policy every year. Most auto insurance policy holders renew their plan with their current company each year without investigating the competition. Family needs change each year, and switching plans could reduce your monthly bill. Use a programmable thermostat. If you don’t currently have a programmable thermostat in your home, get one. You can purchase a moderately priced model for about $40. If you already have one, make sure you’re taking full advantage of its features – some models allow you to program a different temperature for different days of the week. On average, every degree you raise your thermostat in the summer or lower it in the winter saves 2% on your energy bill. Eliminate your Home Telephone line. As long as you have a reliable Internet connection and at least one cell phone in your home, you can save big by eliminating traditional land line service. Products like MagicJack connect a land line to your personal computer via USB, so you can still have the comfort of speaking on a telephone without shelling out the big bucks. Skype is also a convenient (and for most calls, free) alternative to a land line. Make a grocery list. American families throw away about 25% of all the food and beverages they purchase when they do not have a shopping list. Buy what you need, use what you have, and make less if you don’t like leftovers. Take some time and do your research. With some minor adjustments, your financial drip will be fixed. Contact Tom to help stop the drips in your budget. College is the first taste of financial independence for many young adults. For the first time they may be paying their own bills, deciding how to spend their money and managing debt.

Unfortunately, college students don't always make the best decisions. "We've found that the average college student does not come equipped with the information they need to manage their money successfully," says Jacki Brossman-Ashorn, director of the Student Money Management Center at Sam Houston State University in Texas. That's why it's crucial to discuss personal finance with college-bound kids. Here are seven money-management tips:

180 Degree Financial Coaching College Student Coaching Contact: [email protected] 5 Tips for Starting a Debt-Free Conversation With Your Spouse-

The hard conversations are usually the most important for couples. So, if you’re feeling the need for a talk about a debt-free future, but your spouse isn’t quite on board, here are some tips for jump-starting that discussion today. When you were dating, you and your spouse could talk about almost anything. But married couples find that some conversations are harder than others. And if you’re not on the same page about getting and staying out of debt, those talks can be really tough. But the hard conversations are usually the most important for couples. So, if you’re feeling the need for a talk about a debt-free future, but your spouse isn’t quite on board, here are some tips for jump-starting that discussion today. 1. Stop procrastinating. Sure, it’s easier to avoid the conflict by putting off “the talk,” but that’s probably not what’s best for your marriage. For married couples, getting out of debt is definitely a team sport, so you have to talk about it. Remember, when you said “I do,” God turned two people into one (Genesis 2:24; Matthew 19:4–6). As Chris Brown says, “Conflict is inevitable, but drama is a choice.” Work together and have the difficult conversation now to avoid problems later. 2. Reject fear. This goes along with the first point because fear can paralyze us and cause procrastination. But it goes deeper than that. If you know something is right, you can’t give in to fear. God doesn’t operate in fear, and He doesn’t give you a spirit of fear (2 Timothy 1:7), but of love. You have to step out boldly with your spouse even if it means stepping out of your comfort zone. 3. Ask questions—and listen to answers. If your spouse is hesitant, you’ve got two options for finding out what’s going on. You can lecture your better half, but nothing shuts people down faster. Or you can ask questions and really listen to the answers. Questions prove that you want to work together, and they assign value to the one being heard. Just as important, questions break down walls and help you find some common ground. Ask about retirement dreams and your family’s emergency fund. Remember, the idea is to start the conversation about being debt-free some day, so let it be a dialogue—not just a lesson in money management. 4. Explain the benefits of being debt-free. Don’t get all preachy or come in with a ton of charts. That’s no different than lecturing. But try casting a vision for what’s possible. Dream about how generous you could be if you were completely debt-free or how you could leave a legacy for your family. The things holding your spouse back might be making it hard to look up and see the horizon. Give your loved one permission to ask, “What if . . . ?” 5. Pray about it. Honestly, you can’t change your spouse, but God can. He also can uncover areas where you can be more flexible. And He’s promised to give you the wisdom you need if you’re willing to ask (James 1:5). Larry Burkett said that if two spouses are exactly alike, one of them is unnecessary. And when it comes to getting out of debt, both of you are very necessary. But it takes communication and a lot of respect. Your spouse probably won’t transform overnight, but you can gently open the door for debt-free discussions. And when that door is open, hope gets to be part of the conversation. “Putting Knowledge Into Action”

Goal Setting Principles That Work 5 Steps to Goal Setting Keep in mind: Two reasons people do not complete goals. · Stuff will happen, such as major illness, car accidents, job loss, death of spouse and the list goes on. The average person will have 1 major event in any 10yr period. So the importance of an Emergency Fund becomes a major part of your goal planning. The key is how you react to serious setbacks. Do not let them make you a victim. · Procrastination or Doing Nothing. You control the variables. The decisions you make today will control your outcome. Create and implement new Intentional Disciplines. The 7 Goals · Physical · Intellectual · Career · Social · Financial · Family · Spiritual The 5 Steps for having a successful goal plan · Specific: i.e. I want to Lose 20 pounds, not I want to lose weight. I will have 3 months of expenses in emergency fund; know the exact amount i.e. $9000. · Measurable: You can track the goal. The budget will show you the reality of where you are in your goals setting and success. · Time Limit: I will lose the 20 pounds by a specific time or I will have my emergency fund completely funded by a specific date, I will be out of debt by specific date. · Your Goal: Can’t be someone else’s goal. You will not lose the 20 pounds because someone else wants you to lose the 20 pounds. You will not get out of debt because your coach wants you out of debt. It has to be your desire and passion. · Written: Those that accomplish goals have a written plan. That is reviewed frequently. Those that accelerate their goals read them daily and make adjustments when necessary. Seek council before making life changing decisions. “Putting Knowledge Into Action” Keys to Success are the decisions you make: Ask the question: Will this decision I am about to make going to move me towards my goal or away from my goal? Procrastination is the number one reason that kill goals. I will get to it tomorrow, which leads into next week to next year. Do it now! Word of Wisdom: Wise men gather council! ~ paraphrased from Moses the wisest man to ever live. Build your team of like minded people. The journey will be light. Ask for council from those that have the wisdom to show you how to put “ Knowledge into Action” Many people are looking for the golden goose, the magic wand, a one pill solution to solving the maze of financial decisions we are faced with daily, such as how to set up a budget, planning retirement, getting out of debt, paying off the house, saving for children’s college, dealing with creditors and the list goes on and on.

Planning for the future is often difficult when the present moment is just so busy, especially for small business owners who never have a minute to spare. Indeed, according to a recent survey by TD Bank, nearly half of small business owners polled had no retirement plan in place (source: Entrepreneur). But without the steady security of a built-in pension or 401(k) employer match, planning for retirement needs to come first. Follow these 4 tips to make your future a priority, today.

Prepare for risk. True, most entrepreneurs are optimists at heart. But you have to think about worst case scenarios to better assess risk and prepare your business (and yourself) for some of life’s hardships, such as injury, illness, death, and so on. If ever there comes a time when you can’t helm this ship, what would you like to happen to your business? Do you want to sell it? Do you want to pass it on to someone else, such as your child? How much and how to save for retirement will depend on the answer to these questions. Of course, you’ll have to take action to make sure all the legal formalities are in place should you ever step away for whatever reason. Meet with a financial adviser. An accountant or financial planner can help you make more informed decisions about your money, including savings, taxes, and investments. Once you know what you want, a financial planner can tell you how to make that happen. It’s just smart to get an expert to weigh in on these matters, especially if the finance side of the business isn’t your strong suit. If you don’t want to meet a financial adviser, at least take stock of what’s happening. Start saving as soon as possible. Ideally, you started socking away savings for retirement as a young person. Realistically, you probably didn’t. Most people don’t, unless an employer is matching a 401(k) plan and there’s a pension on the table. In general, entrepreneurs are on their own. Whether you see a financial planner or not, you need to decide how to save for retirement. You have many options, including simple, SEP, traditional, and Roth IRAs or regular or solo 401(k)s. Each has its pros and cons, and with a little research you can find the one that is the best fit for you. Grow your business. Having a healthy business that is growing in stature and bottom line is a surefire way to be retirement ready. It will mean more money for the business, its employees, and you. It will increase its value should you ever decide to sell. While you might be tempted to keep putting money back into the business, especially in its infancy, consider paying yourself from the start. This way, you can build up savings well in advance of retirement. And that far-away day won’t catch you off guard. How are you planning for the future? Let us know in the comments below. Being a financial coach, many of my clients are looking for a quick fix or the magic pill to meet a particular financial goal or solution. The reality is there is no quick fix or magic pill to get you on the path of financial success.

Here are 5 Keys to having a successful plan.

Coaching Fee 50% OFF Coaching Packages. [email protected] 608-219-8592 |

AuthorTom Ginn is a graduate of Ramsey's Solutions Financial Coaches Master Series. To learn more about Tom click here. Archives

October 2017

Categories |

RSS Feed

RSS Feed